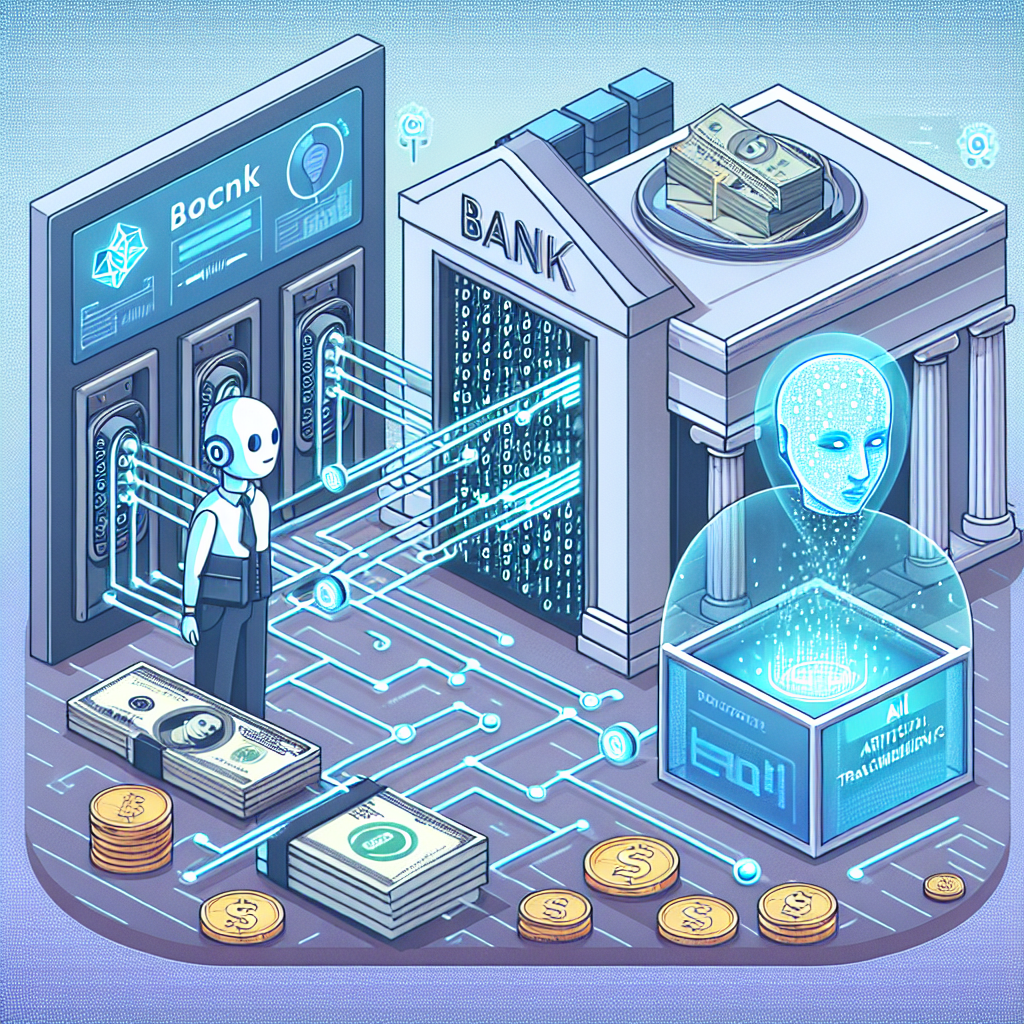

In recent years, two cutting-edge technologies, Artificial Intelligence (AI) and Blockchain, have been making waves in the banking industry. These technologies have the potential to revolutionize the way transactions are conducted and secured, offering a new level of efficiency and security for both banks and their customers. When combined, AI and Blockchain create a powerful synergy that can greatly enhance the security of financial transactions.

AI is a technology that enables machines to mimic human intelligence, while Blockchain is a decentralized and secure digital ledger that records transactions across a network of computers. Both technologies have their own unique benefits, but when combined, they can provide a powerful solution for securing transactions in the banking industry.

One of the key benefits of combining AI and Blockchain is enhanced security. Blockchain technology is known for its high level of security, as each transaction is recorded in a block that is linked to the previous block, creating a chain of blocks that cannot be altered. AI can further enhance this security by analyzing patterns and detecting potential fraudulent activities in real-time. By using AI algorithms to monitor transactions on the Blockchain, banks can quickly identify and prevent any suspicious activities, thus minimizing the risk of fraud.

Another benefit of combining AI and Blockchain is increased efficiency. AI can automate many processes in the banking industry, such as customer service, fraud detection, and risk assessment. By utilizing AI-powered chatbots, banks can provide instant customer support, reducing the need for human intervention and speeding up the resolution of customer queries. Additionally, AI algorithms can analyze vast amounts of data to identify trends and patterns, helping banks make more informed decisions and improve their overall efficiency.

Furthermore, the combination of AI and Blockchain can also improve the accuracy of transactions. AI algorithms can analyze data and detect anomalies in real-time, ensuring that all transactions are accurate and secure. By integrating AI with Blockchain, banks can create a more transparent and reliable system for conducting transactions, ultimately building trust with their customers.

Moreover, the integration of AI and Blockchain can also help banks comply with regulatory requirements. AI algorithms can analyze vast amounts of data to ensure that all transactions comply with regulations and identify any potential risks. By using Blockchain technology, banks can create a tamper-proof audit trail that can be easily accessed by regulators, providing a transparent record of all transactions.

Overall, the combination of AI and Blockchain offers a powerful solution for securing transactions in the banking industry. By leveraging the strengths of both technologies, banks can enhance the security, efficiency, accuracy, and compliance of their transactions, ultimately providing a better experience for their customers.

Frequently Asked Questions (FAQs)

Q: How can AI and Blockchain improve the security of financial transactions?

A: AI can analyze patterns and detect potential fraudulent activities in real-time, while Blockchain technology provides a secure and tamper-proof ledger for recording transactions. By combining these technologies, banks can enhance the security of financial transactions and prevent fraud.

Q: How can AI and Blockchain increase the efficiency of banking processes?

A: AI can automate processes such as customer service, fraud detection, and risk assessment, while Blockchain technology can create a transparent and reliable system for conducting transactions. By integrating these technologies, banks can improve their efficiency and provide a better experience for their customers.

Q: How can AI and Blockchain help banks comply with regulatory requirements?

A: AI algorithms can analyze data to ensure that transactions comply with regulations, while Blockchain technology provides a tamper-proof audit trail that can be easily accessed by regulators. By using these technologies, banks can ensure compliance with regulatory requirements and provide a transparent record of all transactions.

Q: What are some potential challenges of integrating AI and Blockchain in the banking industry?

A: Some potential challenges of integrating AI and Blockchain in the banking industry include regulatory concerns, data privacy issues, and the need for skilled professionals to implement and manage these technologies. However, with careful planning and implementation, banks can overcome these challenges and reap the benefits of combining AI and Blockchain.

In conclusion, the combination of AI and Blockchain offers a powerful solution for securing transactions in the banking industry. By leveraging the strengths of both technologies, banks can enhance the security, efficiency, accuracy, and compliance of their transactions, ultimately providing a better experience for their customers. As the banking industry continues to evolve, AI and Blockchain will play an increasingly important role in shaping the future of financial transactions.