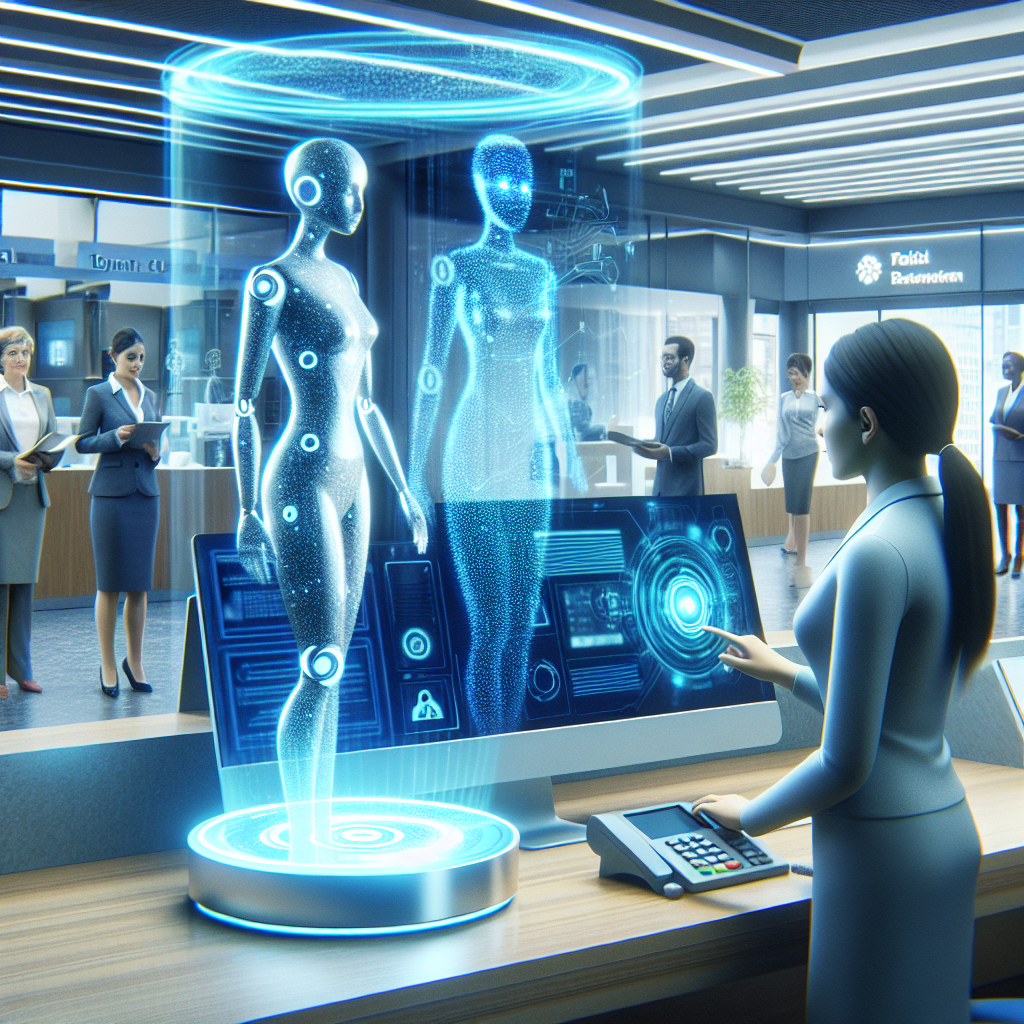

AI-Powered Virtual Assistants: The Future of Banking Customer Support

In today’s fast-paced world, customers expect quick and efficient service from their banks. With the advent of artificial intelligence (AI) technology, banks are now able to provide customers with a more personalized and efficient experience through the use of AI-powered virtual assistants. These virtual assistants are revolutionizing customer support in the banking industry, offering a range of benefits for both customers and banks alike.

What are AI-Powered Virtual Assistants?

AI-powered virtual assistants are software programs that use artificial intelligence and machine learning algorithms to interact with customers in a natural, conversational way. These virtual assistants are designed to understand and respond to customers’ queries, provide information, and perform tasks without the need for human intervention. They can be accessed through various channels such as websites, mobile apps, and messaging platforms, making them easily accessible to customers at any time.

How do AI-Powered Virtual Assistants Work?

AI-powered virtual assistants work by analyzing the customer’s query or request using natural language processing (NLP) algorithms. These algorithms help the virtual assistant understand the context of the query and provide an appropriate response. The virtual assistant can access a vast amount of data and information in real-time to provide accurate and relevant answers to customers’ questions.

Virtual assistants can perform a wide range of tasks, including checking account balances, transferring funds, paying bills, providing product information, and even assisting with loan applications. They can also assist customers with common banking tasks such as resetting passwords, updating personal information, and scheduling appointments with bank representatives.

Benefits of AI-Powered Virtual Assistants for Banks

AI-powered virtual assistants offer several benefits for banks, including:

1. Improved Customer Service: Virtual assistants can provide round-the-clock customer support, ensuring that customers receive assistance whenever they need it. This helps banks enhance their customer service and improve customer satisfaction levels.

2. Cost Savings: Virtual assistants can handle a large volume of customer queries simultaneously, reducing the need for human agents and saving banks on labor costs. This enables banks to streamline their operations and allocate resources more efficiently.

3. Personalized Customer Experience: Virtual assistants can analyze customer data and preferences to offer personalized recommendations and solutions. This helps banks build stronger relationships with their customers and increase customer loyalty.

4. Increased Efficiency: Virtual assistants can perform tasks quickly and accurately, reducing the time and effort required to complete routine banking transactions. This improves the overall efficiency of banking operations and allows banks to focus on more complex tasks.

5. Scalability: Virtual assistants can easily scale to accommodate a growing customer base and handle an increasing number of queries. This flexibility allows banks to adapt to changing customer needs and market demands.

Challenges of AI-Powered Virtual Assistants

While AI-powered virtual assistants offer numerous benefits, there are also challenges associated with their implementation. Some of the key challenges include:

1. Data Privacy and Security: Virtual assistants have access to sensitive customer data, raising concerns about data privacy and security. Banks must ensure that customer information is protected and comply with data privacy regulations to maintain trust and credibility.

2. Integration with Existing Systems: Integrating virtual assistants with existing banking systems and infrastructure can be complex and time-consuming. Banks need to invest in the necessary technology and resources to ensure seamless integration and optimal performance.

3. Training and Maintenance: Virtual assistants require ongoing training and maintenance to improve their performance and accuracy. Banks must invest in training programs and monitor the virtual assistant’s performance to address any issues or gaps in functionality.

4. Customer Acceptance: Some customers may be skeptical or hesitant to interact with virtual assistants, preferring traditional human agents for customer support. Banks need to educate customers about the benefits of virtual assistants and ensure a smooth transition to AI-powered support channels.

Future Outlook

Despite the challenges, AI-powered virtual assistants are poised to become a key component of the future of banking customer support. As AI technology continues to advance, virtual assistants will become more sophisticated and capable of handling a wider range of tasks and queries. Banks that leverage AI-powered virtual assistants will be able to provide a more efficient, personalized, and convenient customer experience, gaining a competitive edge in the increasingly digital banking landscape.

FAQs

Q: Are AI-powered virtual assistants secure?

A: Banks implement strict security measures to ensure that customer data is protected when interacting with AI-powered virtual assistants. Virtual assistants are designed to comply with data privacy regulations and use encryption and authentication protocols to safeguard sensitive information.

Q: Can virtual assistants replace human agents in customer support?

A: While virtual assistants can handle routine tasks and queries efficiently, they are not intended to replace human agents entirely. Human agents are still required for more complex and sensitive customer interactions that require empathy, critical thinking, and problem-solving skills.

Q: How can customers interact with virtual assistants?

A: Customers can interact with virtual assistants through various channels such as websites, mobile apps, messaging platforms, and voice-activated devices. Virtual assistants are accessible 24/7, allowing customers to receive assistance whenever they need it.

Q: What are some common tasks that virtual assistants can perform?

A: Virtual assistants can perform a wide range of tasks, including checking account balances, transferring funds, paying bills, providing product information, updating personal information, and scheduling appointments with bank representatives. They can also assist with common banking inquiries and troubleshooting.

Q: How can banks ensure a seamless transition to AI-powered customer support?

A: Banks can ensure a smooth transition to AI-powered customer support by educating customers about the benefits of virtual assistants, providing training for employees, monitoring the virtual assistant’s performance, and gathering feedback from customers to continuously improve the virtual assistant’s functionality.