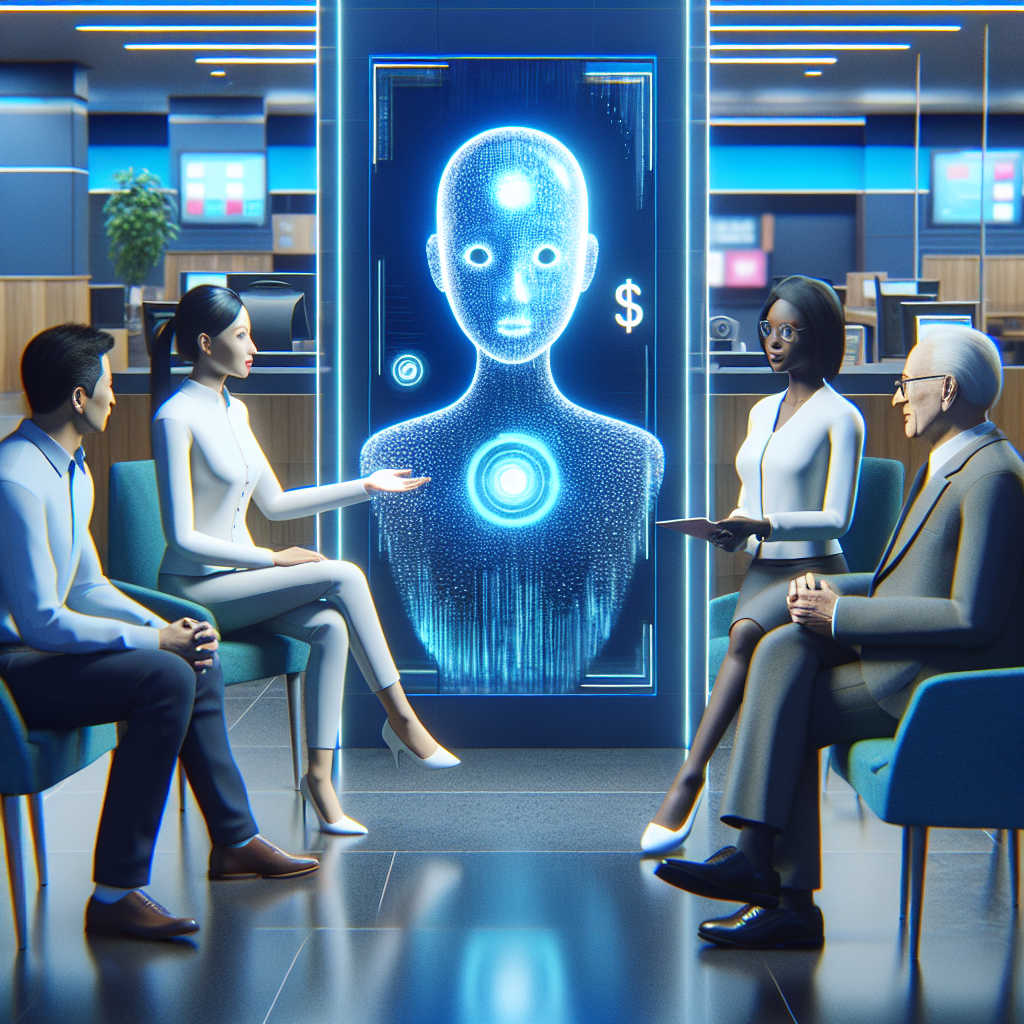

Artificial intelligence (AI) has been making waves in the banking industry, revolutionizing the way financial institutions operate and interact with their customers. One area where AI is particularly promising is in personalized financial advice. By harnessing the power of AI, banks can provide tailored recommendations and guidance to their customers, helping them make informed decisions about their finances.

AI in Personalized Financial Advice

Personalized financial advice is not a new concept in banking. Financial advisors have long been offering personalized guidance to clients based on their individual financial goals and circumstances. However, the traditional model of financial advice is often limited by human capacity and expertise. With the advancements in AI technology, banks now have the ability to leverage vast amounts of data to provide personalized financial advice at scale.

AI algorithms can analyze a customer’s financial information, spending habits, investment portfolio, and other relevant data to understand their unique financial situation. By applying machine learning techniques, AI can identify patterns and trends in the data to make personalized recommendations on budgeting, saving, investing, and other financial decisions.

The potential of AI in personalized financial advice is vast. Banks can use AI-powered chatbots to provide real-time assistance to customers, answering questions and offering guidance on a wide range of financial topics. AI can also be used to develop personalized financial plans for customers, helping them set and achieve their financial goals.

Benefits of AI in Personalized Financial Advice

There are several benefits to leveraging AI in personalized financial advice in banking:

1. Improved customer experience: By providing personalized recommendations and guidance, banks can enhance the overall customer experience and build stronger relationships with their customers.

2. Increased efficiency: AI can analyze vast amounts of data quickly and accurately, allowing banks to provide personalized advice at scale and in real-time.

3. Better decision-making: AI algorithms can identify patterns and trends in the data that human advisors may overlook, leading to more informed decision-making.

4. Cost savings: By automating certain aspects of personalized financial advice, banks can reduce the costs associated with hiring and training human advisors.

5. Enhanced security: AI can help banks identify and prevent fraudulent activity, protecting customers’ financial information and assets.

Challenges of AI in Personalized Financial Advice

While the potential of AI in personalized financial advice is significant, there are also challenges that banks must address:

1. Data privacy: Banks must ensure that customer data is handled securely and in compliance with data privacy regulations.

2. Accuracy and transparency: AI algorithms must be accurate and transparent in their decision-making process to build trust with customers.

3. Regulatory compliance: Banks must comply with regulatory requirements when using AI in personalized financial advice, such as ensuring that recommendations are suitable for each customer’s individual needs and risk tolerance.

4. Integration with existing systems: Banks may face challenges integrating AI technology with their existing systems and processes, requiring significant investment in infrastructure and training.

5. Customer acceptance: Some customers may be hesitant to trust AI algorithms for personalized financial advice, preferring to work with human advisors instead.

Frequently Asked Questions

Q: How does AI in personalized financial advice work?

A: AI algorithms analyze a customer’s financial information, spending habits, investment portfolio, and other relevant data to provide personalized recommendations and guidance on budgeting, saving, investing, and other financial decisions.

Q: Is AI in personalized financial advice secure?

A: Banks must ensure that customer data is handled securely and in compliance with data privacy regulations when using AI in personalized financial advice.

Q: Can AI in personalized financial advice replace human advisors?

A: While AI can provide personalized recommendations and guidance at scale, human advisors still play a valuable role in building relationships with customers and addressing complex financial needs.

Q: How can customers access personalized financial advice through AI?

A: Banks can provide personalized financial advice through AI-powered chatbots, online platforms, mobile apps, and other digital channels.

Q: What are the benefits of AI in personalized financial advice?

A: Benefits include improved customer experience, increased efficiency, better decision-making, cost savings, and enhanced security.

In conclusion, AI has the potential to transform personalized financial advice in banking, offering a range of benefits to both banks and customers. By leveraging AI technology, banks can provide tailored recommendations and guidance to customers, helping them make informed decisions about their finances. While there are challenges to overcome, the opportunities for AI in personalized financial advice are vast, and banks that embrace this technology stand to gain a competitive advantage in the market.