Agriculture is a crucial sector that feeds the world’s growing population, but it is also highly vulnerable to risks such as extreme weather events, pests, and diseases. Crop insurance is a vital tool for farmers to protect their investments and ensure financial stability in the face of unpredictable events. However, traditional crop insurance models have limitations that prevent them from fully meeting the needs of farmers.

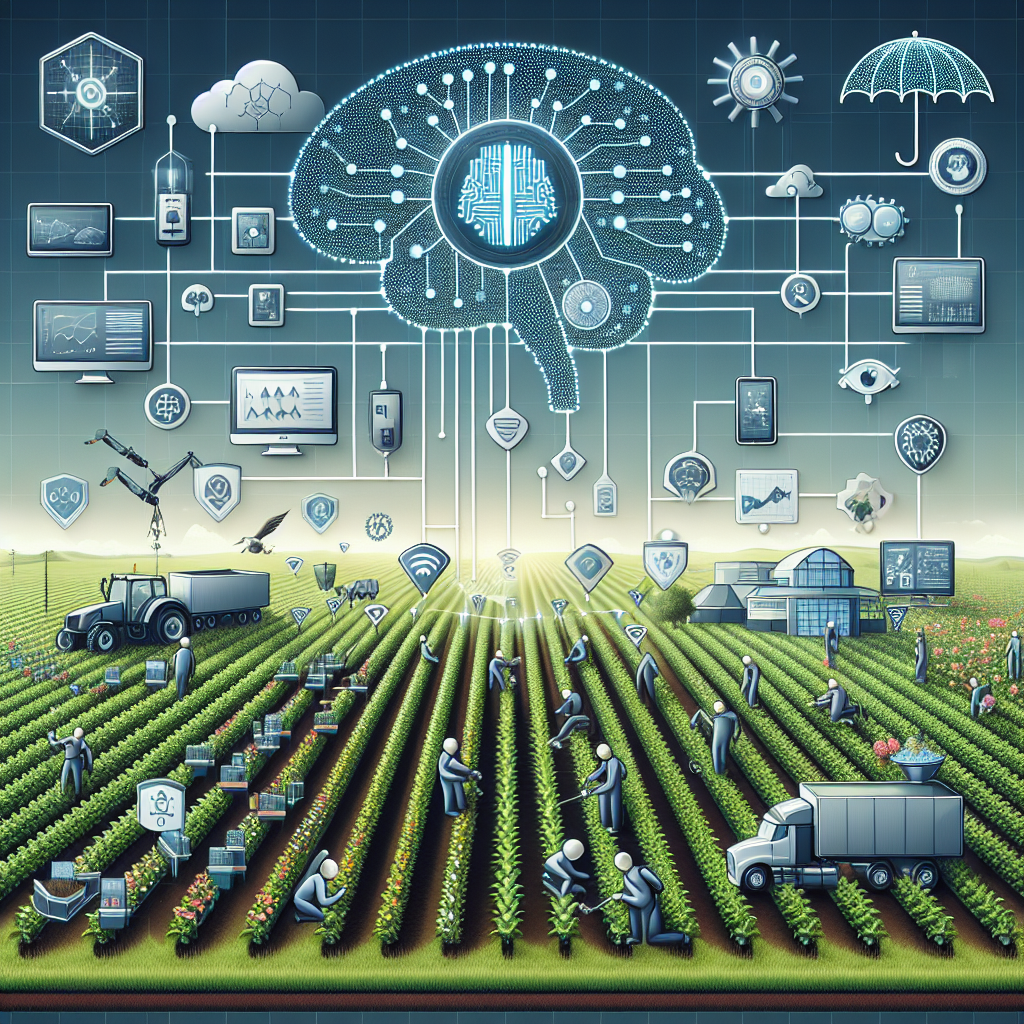

Artificial intelligence (AI) has the potential to revolutionize crop insurance and risk management in agriculture. By leveraging AI technologies, insurers can improve the accuracy of risk assessment, streamline claims processing, and provide personalized insurance products tailored to the specific needs of individual farmers. In this article, we will explore how AI can be used to enhance crop insurance and risk management in agriculture, and discuss some of the benefits and challenges associated with this approach.

Benefits of Leveraging AI for Crop Insurance and Risk Management

1. Improved Risk Assessment: AI algorithms can analyze large volumes of data, including satellite imagery, weather patterns, soil quality, and historical crop yields, to assess the risk of crop failure more accurately. By incorporating these data sources, insurers can better understand the factors that contribute to crop losses and adjust their pricing and coverage accordingly.

2. Faster Claims Processing: AI-powered systems can automate the claims processing workflow, reducing the time and resources required to evaluate and settle claims. Claims can be processed more quickly and efficiently, leading to faster payouts for farmers in the event of crop failure.

3. Personalized Insurance Products: AI enables insurers to offer personalized insurance products tailored to the specific needs of individual farmers. By analyzing farmers’ historical data, crop yields, and risk profiles, insurers can develop customized insurance packages that provide the right level of coverage at a competitive price.

4. Fraud Detection: AI algorithms can detect patterns of fraudulent behavior, such as false claims or inflated crop losses, by analyzing large datasets and identifying discrepancies. By leveraging AI for fraud detection, insurers can reduce the incidence of fraudulent claims and protect the integrity of the insurance system.

Challenges of Leveraging AI for Crop Insurance and Risk Management

1. Data Quality and Availability: One of the main challenges of leveraging AI for crop insurance is the quality and availability of data. Insurers need access to reliable and up-to-date data sources, such as satellite imagery, weather data, and soil information, to train their AI algorithms effectively. Ensuring the accuracy and completeness of these datasets can be a significant hurdle for insurers.

2. Privacy and Security Concerns: AI algorithms rely on vast amounts of data to make accurate predictions and recommendations. However, concerns about data privacy and security can pose a barrier to the adoption of AI in crop insurance. Insurers must comply with data protection regulations and implement robust security measures to safeguard sensitive information.

3. Interpretability and Transparency: AI algorithms are often complex and opaque, making it challenging to interpret their decisions and understand how they arrive at specific conclusions. Insurers must ensure that their AI models are transparent and explainable to build trust with farmers and regulatory authorities.

4. Regulatory Compliance: The use of AI in crop insurance raises regulatory challenges related to data privacy, fairness, and discrimination. Insurers must navigate complex regulatory frameworks to ensure compliance with laws and regulations governing the use of AI in insurance.

Frequently Asked Questions (FAQs)

Q: How can AI improve risk assessment in crop insurance?

A: AI algorithms can analyze diverse data sources, such as satellite imagery, weather patterns, and historical crop yields, to assess the risk of crop failure more accurately. By incorporating these data sources, insurers can better understand the factors that contribute to crop losses and adjust their pricing and coverage accordingly.

Q: How can AI streamline claims processing in crop insurance?

A: AI-powered systems can automate the claims processing workflow, reducing the time and resources required to evaluate and settle claims. Claims can be processed more quickly and efficiently, leading to faster payouts for farmers in the event of crop failure.

Q: How can AI enable personalized insurance products in agriculture?

A: By analyzing farmers’ historical data, crop yields, and risk profiles, insurers can develop customized insurance packages that provide the right level of coverage at a competitive price. AI enables insurers to offer personalized insurance products tailored to the specific needs of individual farmers.

Q: What are some of the challenges of leveraging AI for crop insurance?

A: Challenges of leveraging AI for crop insurance include data quality and availability, privacy and security concerns, interpretability and transparency of AI algorithms, and regulatory compliance issues. Insurers must address these challenges to successfully integrate AI into their crop insurance operations.

In conclusion, AI has the potential to transform crop insurance and risk management in agriculture by improving risk assessment, streamlining claims processing, and offering personalized insurance products. While there are challenges associated with leveraging AI in crop insurance, the benefits far outweigh the drawbacks. By harnessing the power of AI, insurers can enhance the resilience of farmers and ensure the sustainability of the agricultural sector in the face of growing risks and uncertainties.