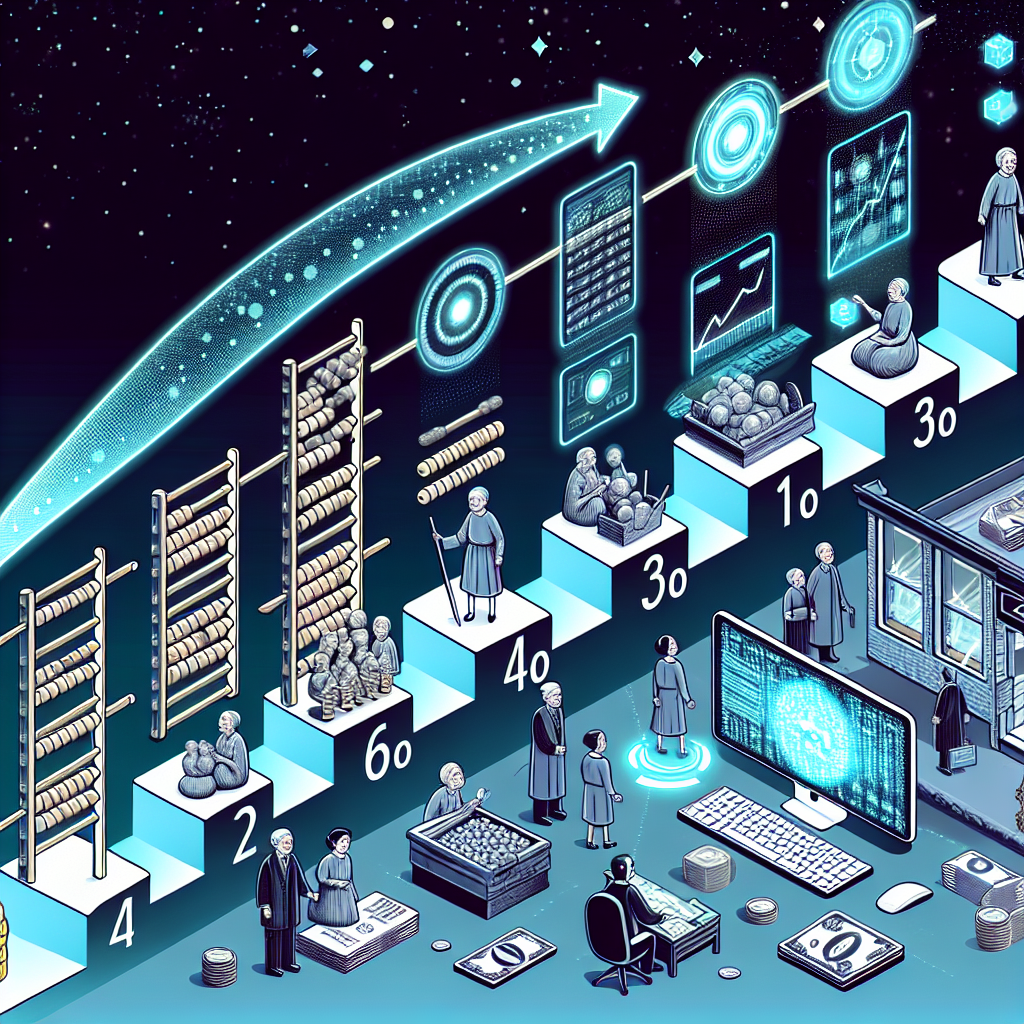

The Evolution of AI-Powered Financial Planning Tools

Financial planning has come a long way in recent years, thanks in large part to the advancements in artificial intelligence (AI) technology. AI-powered financial planning tools have revolutionized the way individuals and businesses manage their finances, providing more accurate and personalized insights than ever before. In this article, we will explore the evolution of AI-powered financial planning tools, their benefits, and how they are reshaping the financial industry.

The Rise of AI in Financial Planning

AI has been steadily making its way into the financial industry over the past decade, with more and more firms incorporating AI-powered tools into their operations. This trend has been driven by the growing demand for more sophisticated and personalized financial advice, as well as the increasing availability of data and computing power.

One of the key advantages of AI-powered financial planning tools is their ability to analyze vast amounts of data quickly and accurately. This allows them to provide more accurate predictions and recommendations than traditional financial planning methods, which are often based on limited historical data and general assumptions.

AI-powered tools can also adapt and learn from new data over time, improving their accuracy and effectiveness. This makes them ideal for helping individuals and businesses navigate complex financial decisions and strategies.

Benefits of AI-Powered Financial Planning Tools

There are several key benefits to using AI-powered financial planning tools, including:

1. Personalized recommendations: AI-powered tools can analyze an individual’s financial situation in detail and provide personalized recommendations based on their unique circumstances and goals. This can help individuals make more informed decisions and achieve their financial objectives more effectively.

2. Real-time insights: AI-powered tools can provide real-time updates on financial markets, trends, and opportunities, allowing users to make timely decisions and capitalize on market movements. This can be particularly valuable for investors and businesses looking to stay ahead of the curve.

3. Risk management: AI-powered tools can assess and quantify risks associated with different financial decisions, helping individuals and businesses make more informed choices and mitigate potential losses. This can be especially valuable in volatile markets or uncertain economic conditions.

4. Automation: AI-powered tools can automate routine financial tasks, such as budgeting, savings, and investment management, saving users time and effort. This can help individuals and businesses streamline their financial processes and focus on more strategic activities.

5. Scalability: AI-powered tools can scale up or down to meet the needs of individuals and businesses of all sizes, from individual investors to large corporations. This flexibility allows users to access the tools and features that are most relevant to their specific financial goals and objectives.

Overall, AI-powered financial planning tools offer a range of benefits that can help individuals and businesses make more informed financial decisions, manage risks more effectively, and achieve their financial goals more efficiently.

The Future of AI-Powered Financial Planning Tools

The future of AI-powered financial planning tools looks promising, with continued advancements in AI technology and data analytics driving further innovation in the financial industry. Some key trends to watch for in the coming years include:

1. Enhanced personalization: AI-powered tools will continue to evolve to provide even more personalized recommendations and insights, tailored to individual preferences, goals, and risk tolerances. This will help users make more informed decisions and achieve their financial objectives more effectively.

2. Integration with other technologies: AI-powered financial planning tools are likely to integrate with other emerging technologies, such as blockchain, Internet of Things (IoT), and quantum computing, to provide even more sophisticated and secure financial solutions. This integration will enhance the capabilities of AI-powered tools and create new opportunities for users to manage their finances more effectively.

3. Regulatory compliance: As AI-powered financial planning tools become more prevalent, regulators will likely introduce new guidelines and standards to ensure the ethical use of AI in financial services. This will help protect consumers and businesses from potential risks and ensure transparency and accountability in the financial industry.

4. Collaboration with human advisors: While AI-powered tools can provide valuable insights and recommendations, human advisors will continue to play a key role in financial planning, providing emotional support, strategic guidance, and personalized advice. The future of financial planning is likely to involve a combination of AI-powered tools and human expertise, offering users the best of both worlds.

In conclusion, AI-powered financial planning tools have revolutionized the way individuals and businesses manage their finances, providing more accurate and personalized insights than ever before. With continued advancements in AI technology and data analytics, the future of AI-powered financial planning tools looks promising, offering enhanced personalization, integration with other technologies, regulatory compliance, and collaboration with human advisors.

FAQs

1. What are AI-powered financial planning tools?

AI-powered financial planning tools are software programs that use artificial intelligence technology to analyze financial data, provide personalized recommendations, and help individuals and businesses make more informed financial decisions. These tools can automate routine financial tasks, provide real-time insights on financial markets, and assess risks associated with different financial strategies.

2. How do AI-powered financial planning tools work?

AI-powered financial planning tools work by analyzing vast amounts of financial data, such as income, expenses, investments, and market trends, to provide personalized recommendations and insights. These tools use machine learning algorithms to adapt and learn from new data over time, improving their accuracy and effectiveness. Users can input their financial information into the tools, which then generate recommendations based on their unique circumstances and goals.

3. What are the benefits of using AI-powered financial planning tools?

Some key benefits of using AI-powered financial planning tools include personalized recommendations, real-time insights, risk management, automation of routine financial tasks, and scalability to meet the needs of individuals and businesses of all sizes. These tools can help users make more informed financial decisions, manage risks more effectively, and achieve their financial goals more efficiently.

4. What is the future of AI-powered financial planning tools?

The future of AI-powered financial planning tools looks promising, with continued advancements in AI technology and data analytics driving further innovation in the financial industry. Some key trends to watch for in the coming years include enhanced personalization, integration with other technologies, regulatory compliance, and collaboration with human advisors. Overall, AI-powered financial planning tools are likely to play an increasingly important role in helping individuals and businesses manage their finances more effectively.