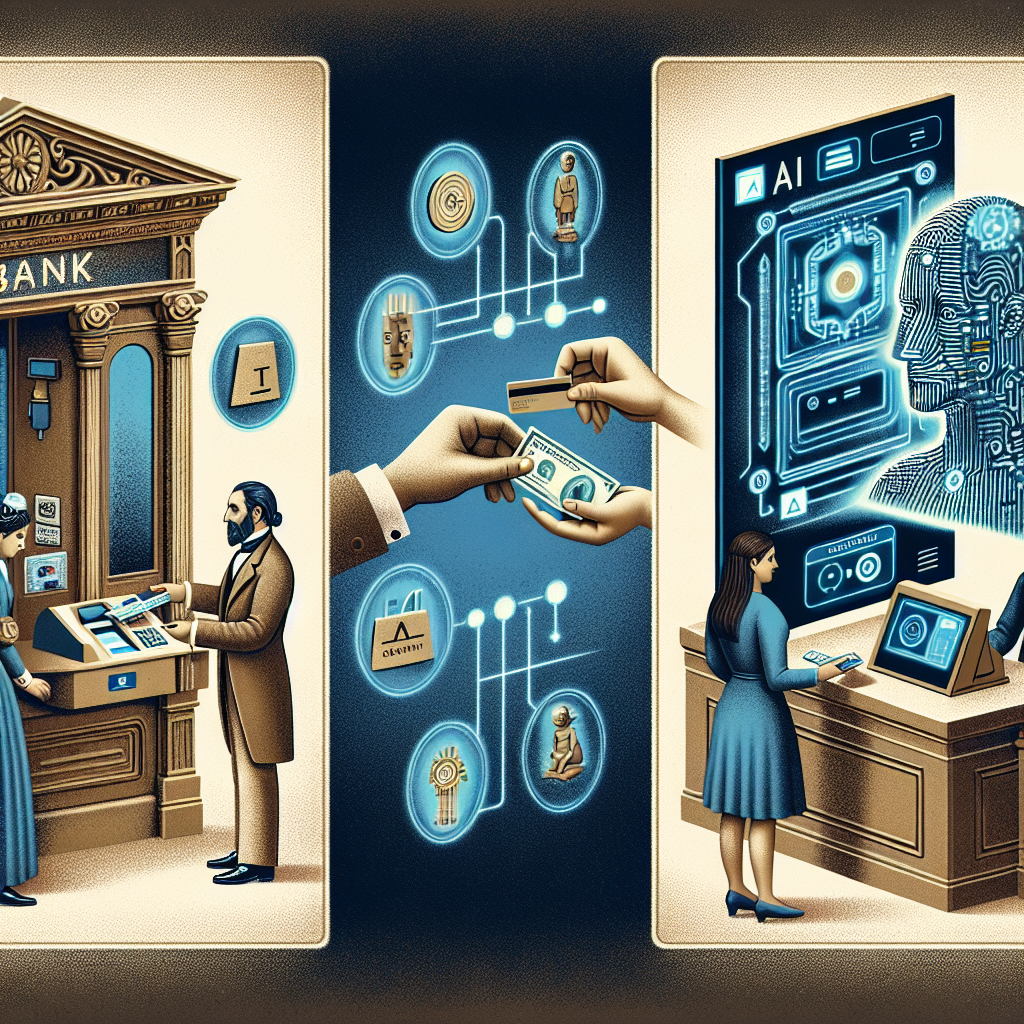

The Evolution of AI-Powered Payment Systems in Banking

In recent years, the banking industry has seen a significant shift towards adopting AI-powered payment systems to streamline operations, enhance customer experience, and improve security. Artificial intelligence (AI) has revolutionized the way financial institutions handle payments, making transactions faster, more efficient, and more secure. This article will explore the evolution of AI-powered payment systems in banking and the impact they have on the industry.

The Rise of AI in Banking

AI has become an essential tool for banks and financial institutions looking to stay competitive in today’s digital age. With the rise of mobile banking and online transactions, there is an increasing demand for faster, more secure payment systems. AI-powered payment systems leverage machine learning algorithms to analyze vast amounts of data and make intelligent decisions in real-time. This allows banks to detect fraudulent activities, predict customer behavior, and personalize services to meet individual needs.

One of the key benefits of AI-powered payment systems is their ability to automate routine tasks, such as transaction monitoring and fraud detection. By using AI algorithms to analyze transaction data and identify patterns of fraudulent activities, banks can prevent unauthorized transactions and protect their customers from financial losses. Additionally, AI-powered payment systems can help banks streamline their operations, reduce costs, and improve efficiency by automating processes that were previously manual and time-consuming.

The Evolution of AI-Powered Payment Systems

The evolution of AI-powered payment systems in banking has been driven by advancements in technology, changing consumer preferences, and increasing regulatory requirements. In the past, banks relied on traditional payment systems that were slow, costly, and prone to errors. With the advent of AI, banks can now offer faster, more secure payment options that meet the needs of today’s tech-savvy consumers.

One of the most significant advancements in AI-powered payment systems is the use of chatbots and virtual assistants to facilitate customer interactions. Banks are increasingly using AI-powered chatbots to provide personalized assistance to customers, answer queries, and help them complete transactions. These chatbots can analyze customer data, understand natural language, and provide real-time responses, making it easier for customers to manage their finances and make payments.

Another key development in AI-powered payment systems is the use of biometric authentication technologies to enhance security and reduce fraud. Biometric authentication methods, such as fingerprint scanning and facial recognition, are more secure than traditional passwords and PINs, as they are unique to each individual and difficult to replicate. By integrating biometric authentication into their payment systems, banks can verify the identity of customers more accurately and prevent unauthorized access to accounts.

Furthermore, AI-powered payment systems are also being used to personalize services and offer targeted promotions to customers. By analyzing customer data and transaction history, banks can identify patterns of behavior and preferences and tailor their services to meet individual needs. For example, banks can use AI algorithms to recommend personalized offers, such as discounts on specific products or services, based on a customer’s spending habits and preferences.

Frequently Asked Questions (FAQs)

Q: How secure are AI-powered payment systems?

A: AI-powered payment systems use advanced encryption techniques and biometric authentication methods to enhance security and protect customer data. By analyzing transaction data in real-time, AI algorithms can detect fraudulent activities and prevent unauthorized transactions, making payments more secure for customers.

Q: How do AI-powered payment systems improve efficiency?

A: AI-powered payment systems automate routine tasks, such as transaction monitoring and fraud detection, which were previously manual and time-consuming. By using AI algorithms to analyze vast amounts of data and make intelligent decisions in real-time, banks can streamline their operations, reduce costs, and improve efficiency.

Q: Can AI-powered payment systems personalize services for customers?

A: Yes, AI-powered payment systems can analyze customer data and transaction history to identify patterns of behavior and preferences. By leveraging machine learning algorithms, banks can offer personalized services, such as targeted promotions and discounts, to meet individual needs and enhance the customer experience.

Q: How are AI-powered chatbots used in banking?

A: AI-powered chatbots are used in banking to provide personalized assistance to customers, answer queries, and help them complete transactions. By analyzing customer data and understanding natural language, chatbots can provide real-time responses and make it easier for customers to manage their finances and make payments.

In conclusion, the evolution of AI-powered payment systems in banking has transformed the way financial institutions handle payments, making transactions faster, more efficient, and more secure. By leveraging machine learning algorithms, biometric authentication technologies, and AI-powered chatbots, banks can offer personalized services, enhance security, and improve customer experience. As technology continues to advance, we can expect to see further innovations in AI-powered payment systems that will revolutionize the banking industry and shape the future of finance.