The Role of AI in Automating Routine Banking Processes and Tasks

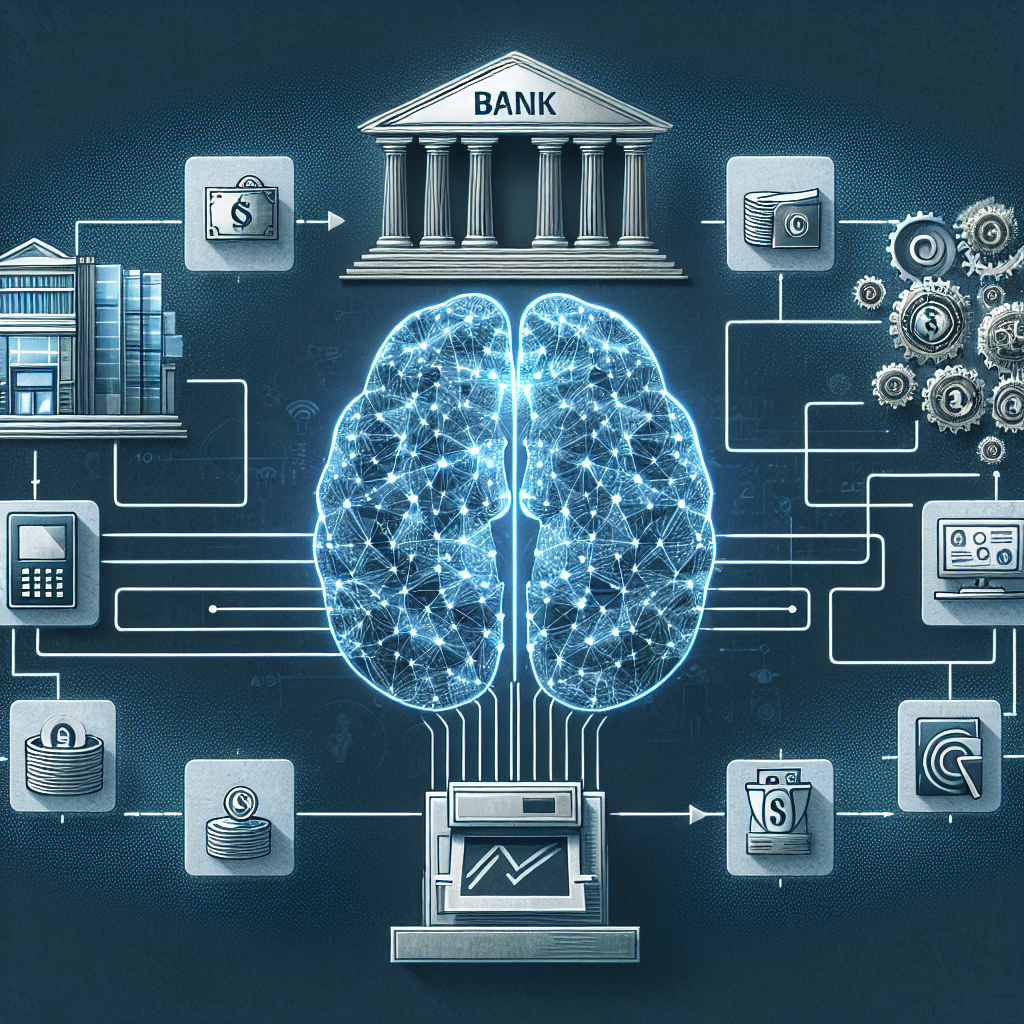

Artificial Intelligence (AI) has been revolutionizing various industries, and the banking sector is no exception. With the rise of digital banking and the increasing demand for seamless and efficient services, AI has become a critical tool in automating routine processes and tasks in the banking industry. From customer service to fraud detection, AI is transforming the way banks operate and deliver services to their customers.

One of the key areas where AI is making a significant impact is in customer service. With the help of AI-powered chatbots, banks can now provide 24/7 support to their customers, answering common queries and providing assistance in real-time. These chatbots are equipped with natural language processing capabilities, allowing them to understand and respond to customer inquiries in a human-like manner. This not only enhances the customer experience but also reduces the burden on human customer service representatives, freeing them up to focus on more complex issues.

AI is also being used to automate routine tasks such as account management and transaction processing. By leveraging machine learning algorithms, banks can streamline these processes, reducing the time and resources required to manually handle them. For example, AI-powered systems can automatically categorize transactions, detect anomalies, and flag suspicious activities, enabling banks to detect and prevent fraud more effectively.

Moreover, AI can help banks personalize their services and offerings to individual customers. By analyzing customer data and behavior patterns, AI algorithms can identify trends and preferences, allowing banks to tailor their products and marketing campaigns accordingly. This not only improves customer satisfaction but also increases customer retention and loyalty.

In addition to customer service and transaction processing, AI is also being used in credit scoring and risk assessment. Traditional credit scoring models rely on historical data and predefined rules to determine a borrower’s creditworthiness. However, AI-powered systems can analyze a wider range of data sources, including social media activity and online behavior, to generate more accurate and predictive credit scores. This enables banks to make better-informed lending decisions and reduce the risk of defaults.

Furthermore, AI is playing a crucial role in regulatory compliance and anti-money laundering efforts. With the increasing complexity of regulations and the growing volume of transactions, banks are facing greater challenges in ensuring compliance and detecting financial crimes. AI technologies such as natural language processing and network analysis can help banks identify suspicious activities, flag potential risks, and report them to regulatory authorities in a timely manner.

Overall, the role of AI in automating routine banking processes and tasks cannot be overstated. By harnessing the power of AI, banks can improve operational efficiency, enhance customer experience, mitigate risks, and stay competitive in an increasingly digital and data-driven world.

FAQs:

1. How does AI-powered chatbots improve customer service in banking?

AI-powered chatbots can provide 24/7 support to customers, answering common queries and providing assistance in real-time. These chatbots are equipped with natural language processing capabilities, allowing them to understand and respond to customer inquiries in a human-like manner, enhancing the customer experience.

2. How does AI automate transaction processing in banking?

AI-powered systems can automatically categorize transactions, detect anomalies, and flag suspicious activities, enabling banks to detect and prevent fraud more effectively. By leveraging machine learning algorithms, banks can streamline transaction processing, reducing the time and resources required to manually handle them.

3. How does AI personalize services and offerings in banking?

AI algorithms analyze customer data and behavior patterns to identify trends and preferences, allowing banks to tailor their products and marketing campaigns accordingly. This improves customer satisfaction, increases customer retention and loyalty, and drives overall business growth.

4. How does AI improve credit scoring and risk assessment in banking?

AI-powered systems can analyze a wider range of data sources, including social media activity and online behavior, to generate more accurate and predictive credit scores. This enables banks to make better-informed lending decisions, reduce the risk of defaults, and improve the overall quality of their loan portfolio.

5. How does AI help banks with regulatory compliance and anti-money laundering?

AI technologies such as natural language processing and network analysis can help banks identify suspicious activities, flag potential risks, and report them to regulatory authorities in a timely manner. This ensures compliance with regulations and helps banks mitigate the risks of financial crimes.